2024 1040 Due Date. Taxpayers in certain disaster areas do not need to submit an extension. Use the calendar below to track the due dates for irs tax filings each month.

Estimated tax payments on income earned during the third quarter of the year (june 1, 2024, through aug. Use the irs tax calendar to view filing deadlines and actions each month.

You Must File Your Extension Request No Later Than The Regular Due Date Of Your Return.

Payment for income earned from january 1 through march 31, 2024.

File Schedule H (1040) And Pay Employment Taxes For Household Employees (File Separately If Form 1040 Is Not Filed) April 15 Estimated Tax Payment For 1St Quarter Of 2024

Federal income tax returns are due on april 15, but there are several other important dates to remember throughout.

The Irs Will Accept The Current Year And 2 Previous Years Of Returns For Regular, Superseded, Or Amended Electronic Returns.

Images References :

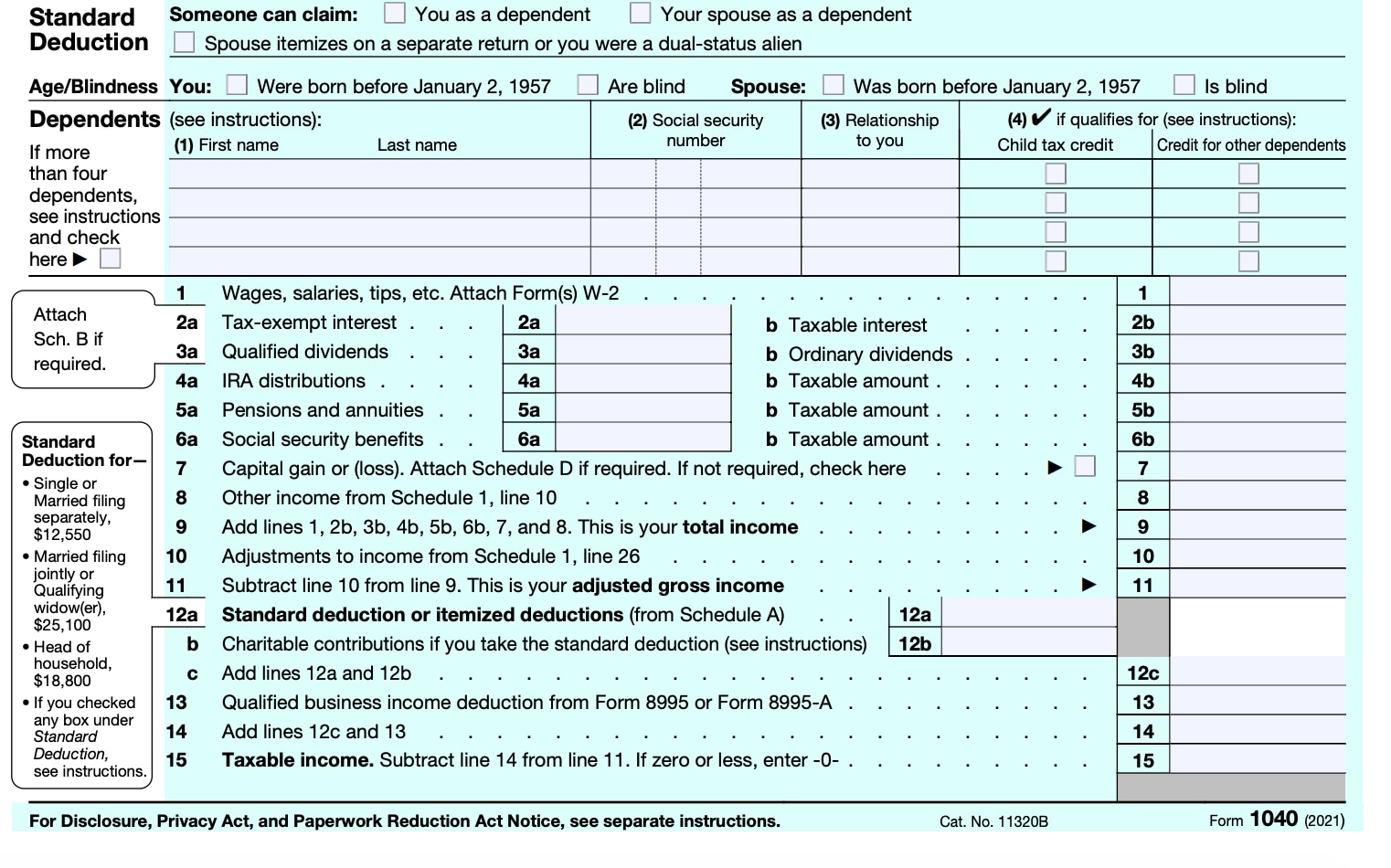

Source: ttlc.intuit.com

Source: ttlc.intuit.com

How to understand Form 1040, File schedule h (1040) and pay employment taxes for household employees (file separately if form 1040 is not filed) april 15 estimated tax payment for 1st quarter of 2024 Form 1065 (partnership) september 16, 2024:

Source: www.aiophotoz.com

Source: www.aiophotoz.com

Form 1040 Fillable Fill Out And Sign Printable Pdf Template Zohal, Payment for income earned from january 1 through march 31, 2024. Use the calendar below to track the due dates for irs tax filings each month.

Source: halettewlonee.pages.dev

Source: halettewlonee.pages.dev

Last Day To File Tax Extension 2024 Candy Nalani, The deadline this tax season for filing form 1040, u.s. The due dates below reflect due dates relevant to filing tax returns or forms in 2024 with respect to the 2023 tax year (assuming a calendar year taxpayer;

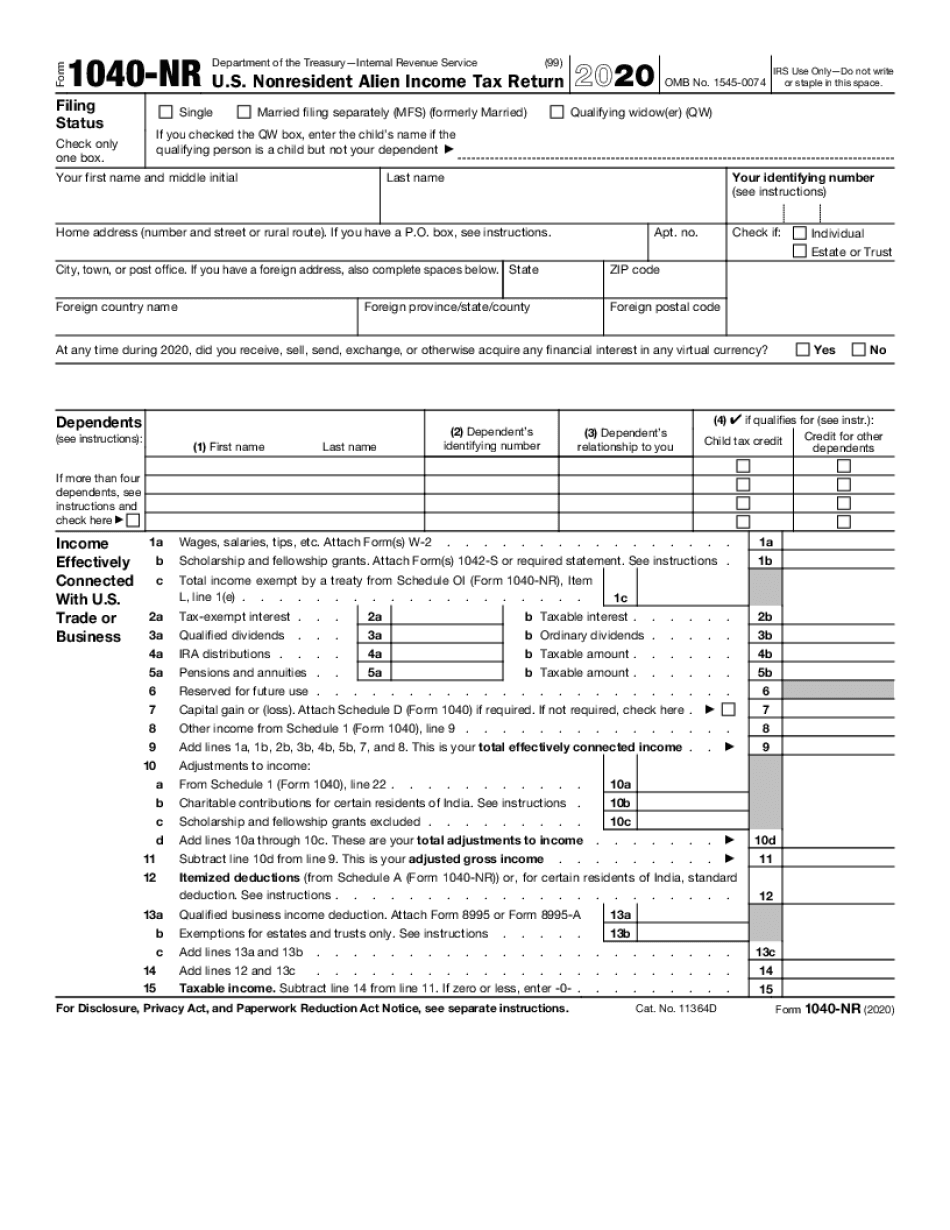

Source: www.dochub.com

Source: www.dochub.com

Free 2022 tax organizer pdf Fill out & sign online DocHub, Taxpayers in certain disaster areas do not need to submit an extension. Access the calendar online from your mobile device or desktop.

Source: www.pinterest.com

Source: www.pinterest.com

2018 1040 Due Date page 9 April 17 2019 for Maine and MA April 15 for, Final estimated tax payment for 2023 due. The irs reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is monday, april 15, 2024.

Source: www.desertcart.no

Source: www.desertcart.no

Buy 2024 Vertical 11×17 2024 Wall Runs Until June 2025 Easy, Taxpayers in certain disaster areas do not need to submit an extension. The deadline to file your federal tax return and pay any federal income taxes you owe is monday, april 15, 2024.

Source: www.taxuni.com

Source: www.taxuni.com

1040 Form 2023 2024, Use the irs tax calendar to view filing deadlines and actions each month. The irs will accept the current year and 2 previous years of returns for regular, superseded, or amended electronic returns.

Source: blog.mozilla.com.tw

Source: blog.mozilla.com.tw

2024 January Calendar, The deadline this tax season for filing form 1040, u.s. For the 2023 tax year, you can file.

Source: marketingmoneypodcast.com

Source: marketingmoneypodcast.com

Tax Season Marketing Money Podcast, Irs schedule for 2024 estimated tax payments; Unless otherwise noted, the dates are when the forms are due to be submitted to.

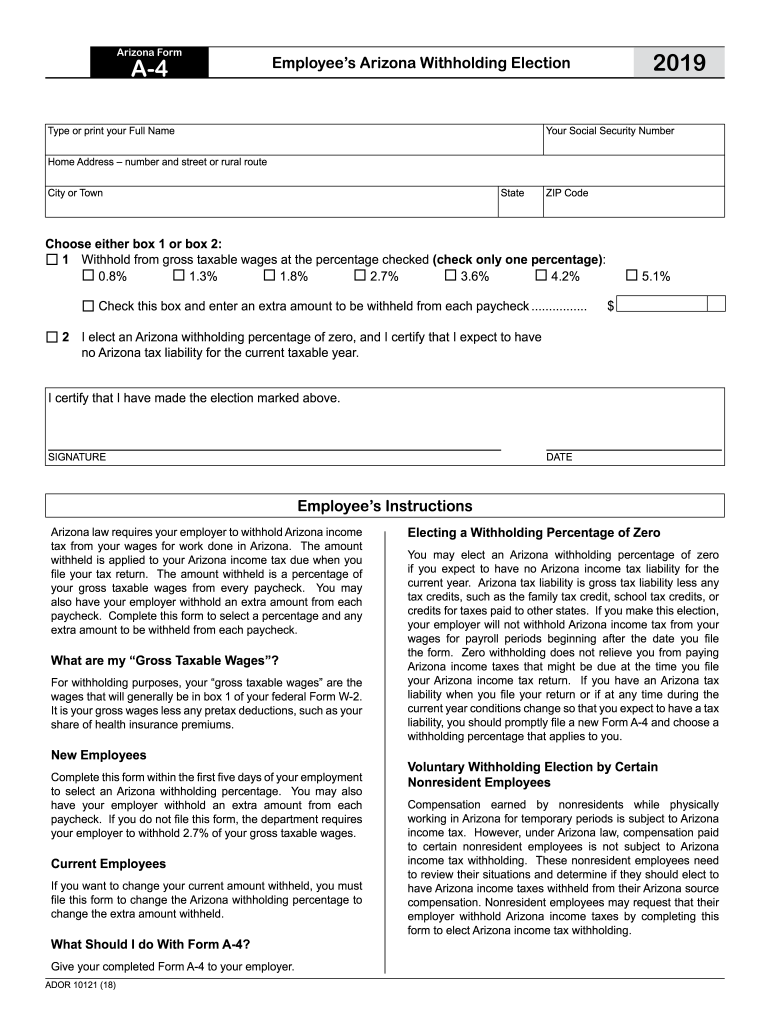

Source: imagesee.biz

Source: imagesee.biz

Printable A4 Form 2023 Fillable Form 2023 1040 IMAGESEE, When income earned in 2023: The due dates below reflect due dates relevant to filing tax returns or forms in 2024 with respect to the 2023 tax year (assuming a calendar year taxpayer;

For The 2023 Tax Year, You Can File.

Use the calendar below to track the due dates for irs tax filings each month.

The Deadline To File Your Federal Tax Return And Pay Any Federal Income Taxes You Owe Is Monday, April 15, 2024.

Access the calendar online from your mobile device or desktop.